Manuel Balce Ceneta/AP

- Democrats want to extend the child tax credit as part of their social spending bill.

- Manchin has led a push to impose a work requirement, which may shut out many families already receiving the cash benefit.

- Democrats may cut higher-earners from receiving the money, targeting it for the neediest.

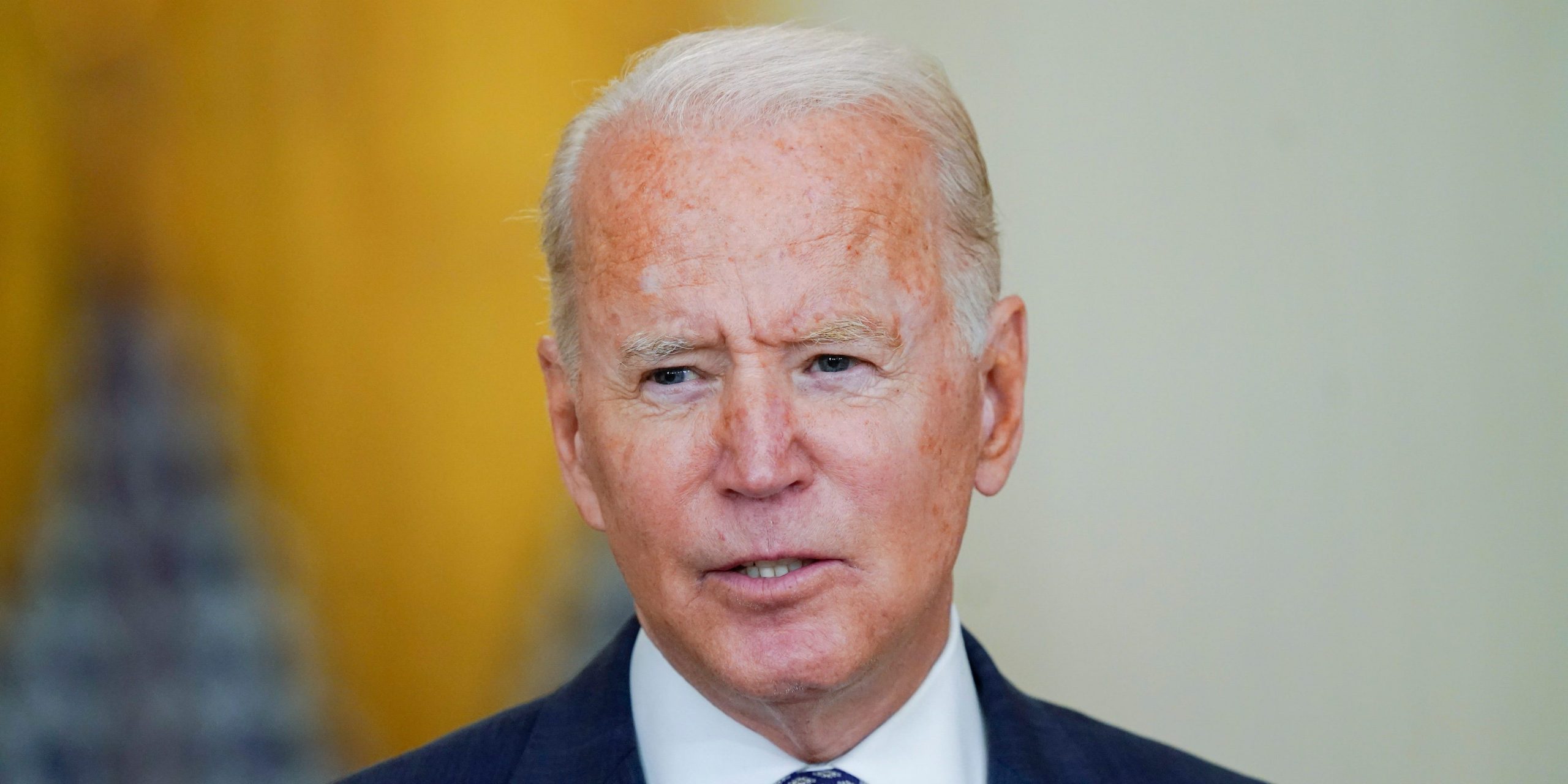

On Friday, cash hit the bank accounts of roughly 36 million families in America. It's the fourth round of direct payments under the Democrats' revamped child tax credit, part of President Joe Biden's stimulus law.

Biden argues the cash benefit is a game-changer for American families, bolstering their ability to put food on the table and pay the bills. Early data indicates that it helped feed 2 million kids in its first month and kept 3 million out of poverty.

Families can get a $300 monthly benefit per child age 5 and under, amounting to $3,600 this year. The measure provides $250 each month per kid age 6 and 17, totaling $3,000. Half the benefit comes as a tax refund in 2022, and people don't need to file taxes to qualify like they used to before this year.

But like most Democratic initiatives at the moment, it faces potential cuts in a nascent social spending bill. The credit forms a big part of their marquee domestic package and most support making the changes permanent. Congressional Democrats, though, are eyeing cuts across the board to satisfy a small faction of centrists like Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona.

Manchin has been on a solo endeavor to impose a work requirement for a month, an attempt to ensure only families who are working and filing taxes can receive the federal aid. He argues restricting eligibility to lower-earning families ensures government assistance will reach the neediest.

The West Virginia Democrat floated a $50,000 income threshold earlier this month. "If you're gonna target, target to people that need it the most, the working," he told HuffPost.

Manchin holds outsized sway of Biden's economic agenda. Democrats are using reconciliation, a legislative maneuver which requires only a simple majority and sets up a path to circumvent unanimous GOP opposition. Democrats need near-unanimity in the House and can't afford a single defection in the 50-50 Senate, meaning Manchin's vote is make-or-break for the package.

Adding a work requirement could shut out millions of families. The previous structure of the child tax credit left out families who didn't earn enough to pay taxes, amounting to 27 million kids who only got part or none of the credit because their families didn't earn enough.

House Democrats want to renew the child tax credit until 2025, betting the benefit will become too politically costly not to renew. It's the same year some individual tax cuts under the Republican tax law are scheduled to expire as well.

"I think 2025 is a compromise," Rep. Suzan DelBene of Washington, one of the expansion's architects, told Insider last month. She argued the income thresholds were already scaled back from $130,000 for singles in her original child tax credit bill to $75,000 in the stimulus law.

There may be some appetite to lop off eligibility among higher-earners, given that part of the credit can reach households making $400,000 a year. Treasury Secretary Janet Yellen hinted at that possibility in an ABC News interview last Sunday.

"We know that programs that are universal have tended to be long lasting and very popular," she said. "But there is also an argument for making sure that the highest income Americans perhaps don't get the benefit of a program that is most needed by those with lower income."

A Senate Democratic aide familiar with ongoing discussions told Insider that Senate Democrats were still eyeing expanding it to 2024, though cautioning that wasn't final given there's still no agreement on a price tag. The person said they may cut eligibility from higher-earners as well.